8 of my favourite consumer-facing tech companies

Hello folks and welcome back to the Substack! Today we’re diving into 8 of my favourite consumer-facing tech companies. Within my Investable universe I’m open to investing in multiple different sectors but I believe I do my best work when it comes to consumer-facing tech stocks, mainly for two core reasons.

Being consumer-facing means we’re all able to try the product first hand and easily understand the company, the purpose and quality of product much easier than for example Business to business SaaS companies such as Salesforce and ServiceNow which are companies the average person may never use or struggle to first hand understand said purpose.

Being consumer-facing means we can very easily gauge sentiment around the company. For example we can easily determine how popular Spotify is, how many people around us use Spotify, how much they value the product and thus how likely they are to continue paying for Spotify.

With the introduction out the way let’s dive straight In.

1. Spotify

Since we used Spotify as our opening example it’s only correct we start here. As you may well know if you’ve read previous content I have a long term holding In Spotify and I’m very bullish for the future of the company.

Spotify is the dominant music streaming platform around today, with a proven moat having not only defended their position but actually came out on top against companies with much bigger budgets such as Amazon, Apple & Google In the audio space.

So knowing that multiple audio platforms do exist what’s the real magic behind Spotify allowing them to have built such a dominant position, being very likely to surpass 1 billion users in the coming years. The answer takes some underlying thinking but on a basic level is very simple.

Firstly they’ve continually had an unrelenting focus on customer satisfaction, management always has been primarily focused on providing ever increasing amounts of value to the user above the need to produce profits. This is the Amazon blueprint, SPOT 0.00%↑ operated this way for a very long time until recently they decided to turn on the profit tap thus exploding Free cash flow which in turn has caused the stock to reach all time highs.

Seeing this blueprint happen in real time is the reason I’ve been successful in Spotify & is a core principle I’m looking for when researching companies.

Secondly they had the first mover advantage and prioritised one thing, audio. Companies like Apple & Amazon have other focuses and Audio is just another vertical, Spotify is obsessed with audio & audio only.

When you blend all this together you have a fully focused team whose only priority is continually innovating to bring the best audio platform, prioritising the user experience ensuring the price to value ratio remains favourable. Now Spotify has a giant user base which is very sticky, It’s likely when we look at all our subscriptions Spotify is the least likely one we would choose to cancel. In fact the price could double for Spotify over the next years and nobody would blink an eye, the former statements can be backed up by this previous poll ran on my X account. Whilst 48 votes is a small sample size the result speaks volumes.

Now when looking at Spotify today we see an incredible company, with a strong moat, innovative management team in which we still have a young hungry founder at the wheel, great culture, exploding Free cash flow, improving margins significantly all whilst expanding into multiple new verticals such as Visual content, Podcasts, Audio books, educational courses, advertising, utilising AI to improve the experience and much more down the line.

Spotify is also quietly going about becoming the middle platform linking creators (musicians and podcasting content creators) to their fans as Spotify is using data to determine what you like and then market you either merchandise or concert tickets when they know your favourite artist is performing close to your location, which over time could be a huge business for Spotify.

The future roadmap is both clear and exciting, I could continue but I’ll just show you this chart instead :)

If You’d like to follow me over on my X account I’d very much appreciate that, the link is just below :)

2. Amazon

We all know just how amazing Amazon is both as a business to invest our money with but also as a service to make our daily lives both easier and better. Speaking on the prior mentioned price to perceived value ratio in the eyes of the consumer, this all originally stemmed from Amazon & it remains true today as the Amazon Prime subscription is a no brainer for all of us to have.

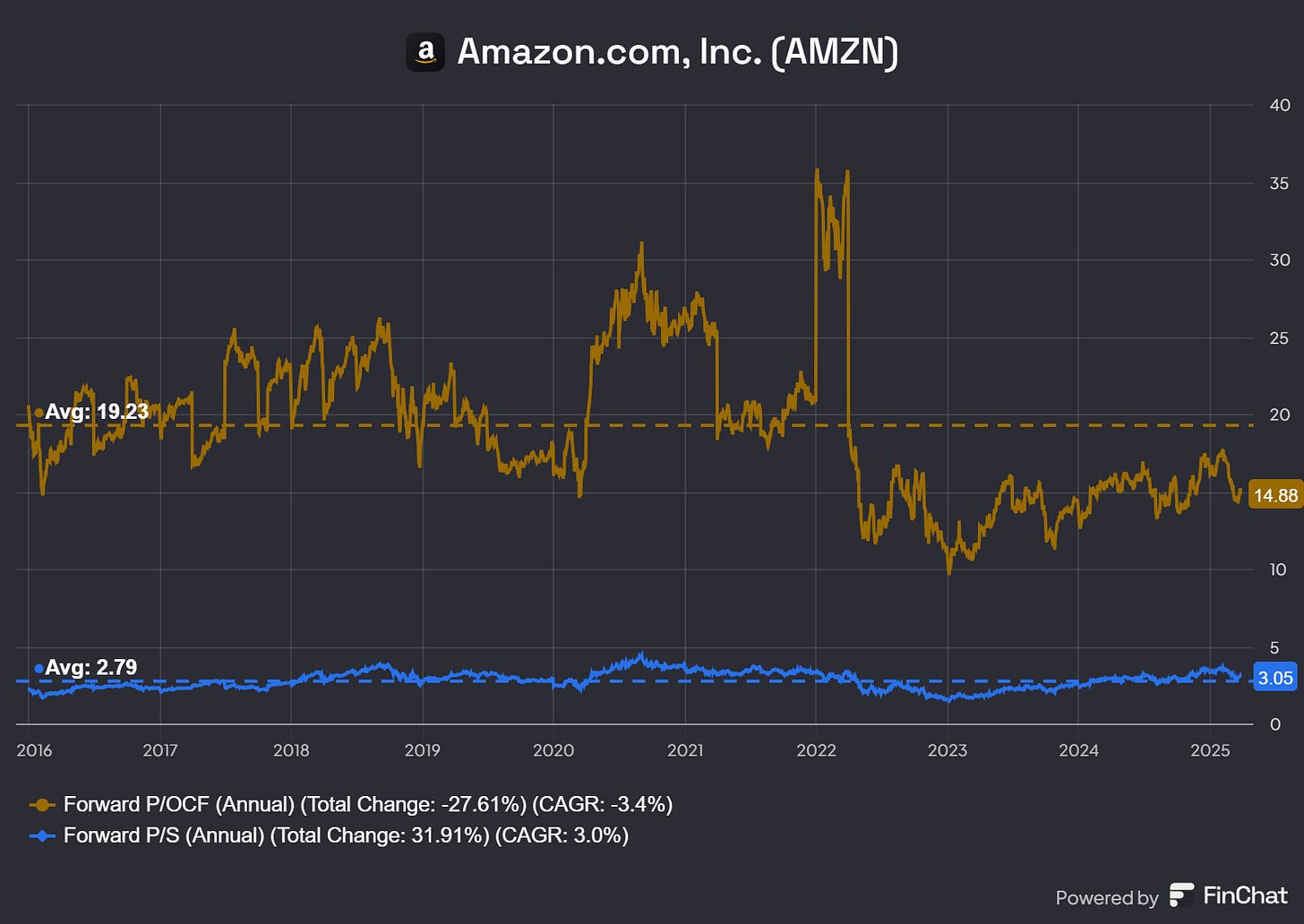

We don’t need to go on about AMZN 0.00%↑ for ages, we all know the value they bring to us as consumers and the immovable moat they’ve fortified themself with.

Of course they have a leading position in e-commerce and logistics, through the Amazon market place they’re the third largest advertisers, the potential for Prime video remains exciting as more TV hours continue to move away from Cable TV towards streaming which increases Ad potential & Primes pricing power, then moving away from the direct consumer side they’re the leading cloud provider and a very underrated AI & robotics company, besides that I don’t really have any unique perspectives but I do believe today is a great buying opportunity. Amazon is also a company I own in my portfolio.

3. Uber

My largest position currently in the portfolio representing 19% is Uber. Whilst shares of UBER 0.00%↑ are up over 100% since I first entered the stock, todays valuation is the cheapest Uber has ever been in my opinion.

We all know how great Uber is, how much convenience they bring to our daily lives both through rides and eats, the core business is solid but the long term thesis is truly becoming exciting.

The Moat is strong built around an incredibly powerful network effect, bolstered by branding power with Uber being one of the few companies to reach verb status, the word Uber is now synonymous with Taxis.

In recent years Uber went through a big change regarding management with current CEO Dara Khosrowshahi replacing the founder Travis Kalanick. Whilst Travis was the perfect fit to propel Uber to the heights they achieved, the company was ready for a change and they couldn’t have chosen a better fit than Dara, backed up by the incredible turnaround in the financials with Uber now being a lean mean cash machine.

We know Uber has a solid moat now paired with an excellent management team topped off with ever improving financials so we now must map out the future runway, which is truly exciting.

So Uber has an incredible core business within Rides & Eats which still has a very long runway both in their existing markets as they continue to increase average revenue per user through pricing & higher utilisation of the platform. But also they have many new untapped markets for Uber to expand in over time all across the globe.

The Eats platform is very exciting, If you’ve been paying attention you’d have realised Uber Eats is expanding into verticals beyond just fast food as they now offer groceries and retail products. The delivery platform will expand into a total delivery network to rival Amazon down the years as the blueprint for fast food is easily duplicatable as long as the retail item is in store locally.

A personal example is the other week I urgently needed batteries, instead of heading to the store I ordered them on Uber Eats and they arrived within 30 minutes, this kind of speed blows Amazon out of the water.

This combined with Ubers membership UberOne which is growing meaningfully is an exciting proposition because, firstly it strengthens the moat as once your a member you aren’t going to use other services & you subconsciously use Uber more proven by the fact members spend 3.5x more than non members. Secondly The membership provides further value to users through free delivery & discounted rides, once again referring to Amazon we’ve seen how valuable certain essential memberships can be over the long run.

The Rides platform is quickly evolving into a total travel app offering numerous ways of travel beyond just a taxi, overtime with the current CEOs background with Expedia Uber can likely become a travel platform similar to Booking holdings.

Then we get round to the likely reality that Uber will be the main platform aggregator for Autonomous Vehicles, a reality we’re already seeing take place with Uber having multiple partnerships within the AV sector, essentially on a deeper level considering all the underlying data, Uber can be AWS for AVs.

Right now the company is executing flawlessly on every metric, whilst expanding into new exciting verticals. The numbers today are great and the future story is compelling, the stock is priced cheaply in my opinion being one of, if not the best value on the market today. Sentiment is negative due to uncertainty regarding the future with AVs but in reality Uber is in a strong position here but even so is reorganising the business so It’s not solely reliant on Rides anyway.

This is a great example of an antifragile business, which if the thesis plays out entirely will become one of the biggest businesses in the world and thus a huge part of consumers lives on a daily basis.

4. Meta

Another core position in the portfolio is Meta, we all know how great this company is and how they have created an underlying advertising powerhouse embedded into our favourite social media apps.

With Over 3.3 billion daily active users across their family of Apps Meta literally has no competition. This is spread across Facebook, Instagram, Whatsapp, threads and others.

What’s even more incredible is this number is still increasing gradually but even once it’s truly maxed out Meta can continue increasing revenue by increasing ARPU, especially in markets outside the US where at present there’s a stark difference.

Meta’s AI verticals are actually exciting both on the hardware and software side, with the hardware products having massive potential which isn’t really priced into the stock thus meaning META 0.00%↑ is actually one of the most asymmetrical opportunities within AI today on the market.

We can keep this short and sweet because we all know Meta but we simply can’t have a top Consumer-facing tech stock list without the kings of social media Meta.

5. Duolingo

The worlds most valuable Owl, Duolingo is turning into an incredible story. The company continues to prove they have incredible processing power which leads me to believe the upside here is pretty unlimited.

The company has a strong moat with essentially no competition, of course other educational companies do exist but not to the standard of Duolingo when we consider the gamification approach, we know that the biggest issue faced when learning is motivation and Duolingo’s addictive style brings an end to such an issue.

It’s clear that DUOL 0.00%↑ engaging approach is working as they now have over 10 million users with a streak over 1 year, total Daily active users now sits at 40.5million (up over 50% year over year)

Free Cash Flow is compounding meaningfully with the margin now reaching 39% in the most recent quarter, rule of 40 score coming in at 82, a great founder running the company you quickly realise this is a special situation in the making.

Whilst the current level of execution is fascinating the future roadmap is even more exciting. Essentially in the simplest terms Duolingo’s blueprint for such success in languages is easily duplicatable across multiple subjects. Which means Duolingo will likely evolve into a complete educational suite, likely to become mandatory learning material within schools across the globe, In some cases replacing the educational system as we know it.

Many people have concerns about AI when regarding Duolingo but they fail to realise that AI continually improves Duolingo’s product as additional data strengthens the flywheel and thus improves the product offerings and user experience.

Duolingo will likely evolve into one of the biggest consumer-facing technology companies in the world but for such a thesis to become reality it will likely take multiple decades. For now they’re just an amazing language learning tool which brings great joy to us as users.

6. Airbnb

Jumping into the first company on this list I don’t currently have a position in we’re looking at Airbnb, a company which I’m sure we’re all familiar with and another company which has made it’s way to verb status for many people completely changing the travel game.

For me If I’m honest I still prefer staying in hotels and resorts on my travels, simply for the additional bonuses you experience through this approach but I’m not against Airbnb, I see the appeal and ultimately I’d be a bad Investor to disregard what the company is doing just because it’s not my number one choice.

I admire the network effect this company has, similar to Uber when we come across companies with two sided network effects, overtime giant moats are made, you arrive at a scenario in which scale has become so large it becomes near impossible to disrupt, on top of this I personally continue to be impressed with the Founder & CEO Brian Chesky, one of the great innovators of recent times.

The company continues to perform to a high standard with revenue growing 12% year over year as of Q4 2024, bringing in $2.5 Billion for the quarter and $11.1 Billion for the full year, the company finished the year with a net profit margin of 24% FCF margin of 40%, (FCF is higher regarding Airbnb because they collect interest on payments made months in advance for future trips the metric does become inflated and choppy depending on the time of year, In march FCF margin was 90% yet December it was 18% so for the complications here I like to just focus on Net profit.)

GBV in Q4 2024 was $17.6 billion, up 13% year-over-year, which saw the full year GBV total $80.8B

ROIC for the full year sits at 16.5% whilst management are also focused on buying back shares which I like, with LTM buyback yield being over 5%. Since 2022 the buyback yield has been north of 2%

All things considered I think it’s clear that Airbnb is a pretty good outfit, whilst the company is obviously maturing It’s also true that the runway for growth is still long as they continue to expand but also innovate through new verticals, all at the same time printing cash and being friendly to shareholders.

For now I’ll continue to enjoy monitoring this space.

7. Booking Holdings

Continuing the travel theme, but now we’re onto a company I used to own in the portfolio before I sold it for a profit to deploy capital into a different Investment, Booking Holdings. It’s also true I prefer the experience and the business of Booking.com

Booking is a company which often can be misunderstood, for my readers in Europe I’m sure you’re more than familiar with how strong this moat is, US Investors tend to underestimate It’s power but this stems from Bookings dominance in Europe due to majority of the hotels being independent when compared to America, where they are mostly chains. This means the need for Booking In Europe is far greater & thus Booking has one of the strongest Network effects you’ll find.

Ultimately with Booking Holdings we’re talking about one of the highest quality businesses you’ll find, very high margin with strong return on invested capital, clean balance sheet, strong moat with wide scale, still growing nicely, a very good management team with a CEO whose been at the company 23 years, shareholder friendly, focused on aggressively buying back shares and paying a growing dividend. Whilst shares are up 30% since I first touted BKNG 0.00%↑ a buy in may 2024 to my followers, I still believe today is a reasonable entry price for the long term Investor at 22x forward earnings.

I mention these two previous companies because I believe with the rise of AI in the ever increasing digital world, people will yearn for in person experiences, which Airbnb & Booking will likely aggregate this space between the two companies, possibly shared with the aforementioned Uber.

8.Netflix

Back to a company I own in the portfolio Netflix.

Netflix is a company I’m very bullish on long term, it has all the traits of an antifragile business and is a position I’d like to build into a cornerstone of the portfolio in the right moment, for now it’s about a 4% holding.

What’s made Netflix so successful over the years is a combination of incredible culture alongside once again the theme of providing mass amounts of value in the eyes of the consumer, If you’d like a deeper understanding on the history of Netflix I recommend these two books. “That will never work” and “No Rules rules”

When we look at the wider landscape today it’s clear that the legacy media companies are struggling. People no longer trust the news, preferring to seek their own personal news sources such as YouTube & Podcasts. On top of this our generation today is no longer interested in cable TV, choosing to consume content on streaming platforms In which Netflix has cemented a dominant position. All that’s really going for the legacy TV companies is Sports, which also is gradually making it’s way towards the streaming platforms, currently most notably on Amazon prime but now also Netflix as seen at the back end of 2024.

Netflix provides an incredible amount of value now across multiple priced tiers, which further reinforces the statement that they’ve evolved into an all weather business.

Whilst Netflix already has a dominant position in streaming, the runway for growth is actually much greater than you might first imagine both to add new users but to take more eyeballs away from legacy TV over time, as of September 2024 NFLX 0.00%↑ accounted for just 8% of total viewing time in the US thus proving clearly a vast amount of market share remains available to obtain.

It’s likely that Netflix will see massive success by firstly continuing what they’re doing, making incredible content which consumers love, continuing to get those global hits which adds to Netflix’s IP which overtime they can monetise just like Disney did. On top of this new verticals like the advertising tier has massive potential, but even more notably sports.

As long as Netflix continues to scale value to the consumer they’ll have no problem raising prices for a long duration.

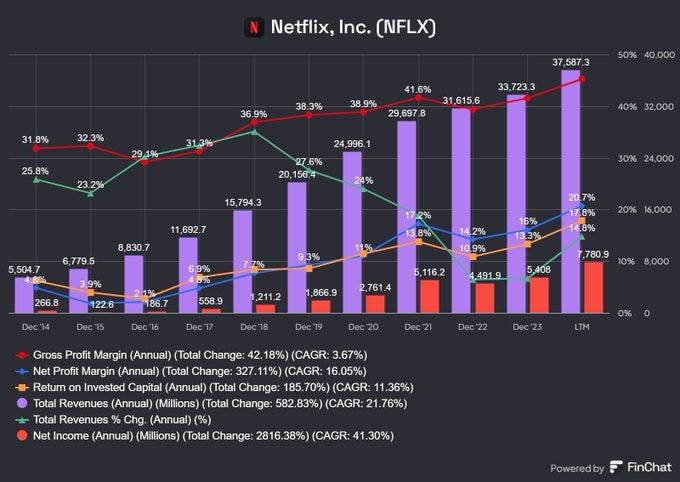

Like any investment we need to blend the future story alongside the current execution, which is also looking promising today, see the graph below to visualise just how well Netflix are executing.

That’s all for today folks, if you enjoyed this style of content please consider liking and sharing with a friend, as honestly that helps me out massively. I’m happy to do a part two on consumer-facing tech companies if you found this valuable, or we can cover any other industries which interest you. Please let me know in the comments below. Until Next time thanks for reading :)

Remember nothing in this article should be considered financial advise and is purely for entertainment purposes. Always do you’re own due diligence.