Finding 100 Baggers

Some quick lessons we can find studying the best stocks of the past

Everyone would love to find a 100 bagger when it comes to investing & one great way to increase these odds are studying previous 100 baggers, we have many different examples we could look into but today we’ll inspect four companies, which to me have unique lessons which all investors can take.

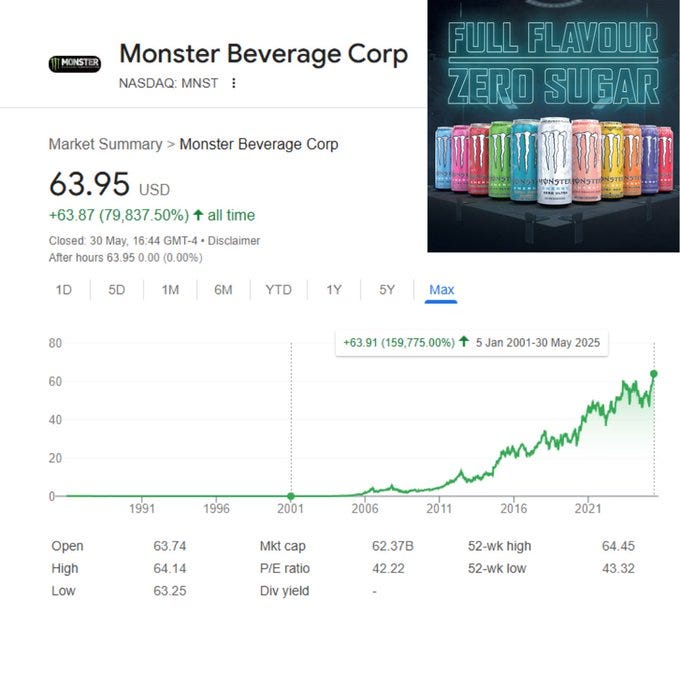

1)Monster Beverage MNST 0.00%↑

Everyone knows Monster by now but you may be surprised to learn that Monster has returned 159,775% since 2000.

The Company provides us with many different lessons but to me I see three clear things to take away.

You don't need to find the next best "Innovative tech stock" to achieve great success in the market

Monster really understood their niche audience and catered specifically to those individuals, especially in the earlier days which in turn resulted in a loyal following which they still have today at their core, despite now being entirely mainstream

Competition can become your ally, Monster were wise to partner up with competitor Coca Cola which in turn supercharged growth because they got to capitalise on Cokes distribution network.

2)Apple AAPL 0.00%↑

Everyone knows what a massive success Apple has been in the market but I find one key aspect of this story fascinating.

A turn around story can become a massive success if the company manages to reinvent themself and this may have some relevance to Tesla today.

It wasn't Apple’s original product which delivered them massive success, whilst TSLA 0.00%↑ is already a 100 bagger, this thinking is why Tesla investors believe the company has a good chance of reigniting massive growth as anticipated products such as humanoid robots & FSD become reality. For context Apple had stalled and was close to bankruptcy before Steve Jobs returned, the Company began to turn around and later down the line in 2007 the Iphone was released. This does make me think of Tesla whilst they aren't in the trouble Apple once was, it is possible they may have their "Iphone moment"

The power of branding and the moat you can build when you can own the ecosystem

3)Netflix NFLX 0.00%↑

A personal favourite for most people Netflix has experienced huge success, with a split adjusted price of $1 at IPO, today NFLX 0.00%↑ trades for $1207.

I see three clear lessons which relate to how this company returned immense success for shareholders.

Offering a real counter position to an industry can be so successful you actually create your own industry

Being the first mover has significant advantages

Creating a personalised experience for the consumer is everything

These lessons make sense of why people like the analogy of HIMS 0.00%↑ day with NFLX 0.00%↑

4)Adobe $ABDE

Since IPO in 1986 ADBE 0.00%↑ has returned over 250,000% & has returned over 100x since the 2000 lows. The key lesson around Adobe is amazing.

Being able to shift business models and the true power of a subscription based service.

You may know Adobe used to sell editing tools as an expensive one time service which people would use for a while until the next edition came out, eventually they shifted to purely software & charged a cheap recurring monthly subscription and revenues just exploded.

Like Apple they also understood the power of owning an ecosystem & the overall creative industry.

If you did find this concept interesting I recommend reading the book "100 Baggers" by Chris Mayer.

This is one of my favourite books to read. We'll finish with the key lesson about 100 baggers in my opinion.

They take time, on average it takes around 30years to return 100x and more, with that in mind don't sell your winners early, let them run & Remain patient with your returns, with management and with your thesis.